When hiring a global workforce, finding the right people for your business is as much about their wants and requirements as it is about yours. The world’s top talent knows what they’re worth — and they’re unlikely to settle for anything less.

But salary expectations differ enormously from country to country — even for the same role and job description. So, it’s essential to have a benchmark to base your international salary pay packets on.

However, there’s more to employment costs than basic salary. Although employees see the same figure entering their bank account each month, there are various behind-the-scenes employer costs that workers never see.

The cost of employing someone can be anywhere from 1.25 to 1.4 times higher than the person's base salary, depending on the country. This means that employing someone in France could be much more expensive than employing someone in the UK — despite paying the same salary. Many countries also mandate 13th-month salaries (an end-of-year bonus that typically matches an employee’s monthly salary).

As such, organisations need to consider the varying costs of international salaries around the world, including in-country taxes and statutory benefits, when hiring in different countries. Not to mention balance the costs of employing with the pros of hiring workers in that country, such as access to a highly skilled and educated workforce.

So, how do salary ranges and employer costs differ across the continents? Let’s take a closer look…

Europe

Europe is notorious for its high salaries and costs of employing someone, but this isn’t necessarily true for every country across the continent.

There aren’t any employer costs when hiring in Macedonia, for example. Employees bear the entirety of their social security contributions, with the employer deducting the contributions on behalf of the employee. Coupled with a low monthly minimum wage of MKD 22,146 (roughly GBP 300.60), Macedonia presents itself as an affordable place to hire new talent.

In stark comparison, Denmark imposes high taxes on employers: a standard sum of DKK 13,721 (GBP 1,539.83) per month rather than a percentage of an employee’s salary. Yet, the country also offers some of the best employee benefits packages, particularly with regard to childcare.

Italy also poses significant employer costs at 32.4%. Whilst there’s no national minimum wage, the average works out at about EUR 2,255.28 (GBP 1882.97) monthly. And if you’re looking to hire in Geneva, Switzerland’s national minimum wage is CHF 4,000 (GBP 3,283.47) per calendar month, with employer costs making up around 9.5% of this. However, these two wealthy nations sit at the heart of European innovation, with strong economies and ample opportunities for business expansion.

Asia

Employing in China will set you back 40.92% of your employee’s salary. Although it has one of the highest employer costs in the world, China’s average national minimum wage is reasonably low, differing from region to region. The minimum monthly wage is CNY 2,230 (GBP 268.52) in Beijing, CNY 2,590 (GBP 299.77) in Shanghai and CNY 2,200 (GBP 254.63) in Shenzhen. Moreover, the country’s workforce is renowned for its loyalty and impressive work ethic, meaning you’re likely to reap the rewards long-term.

India offers more of a middle ground at 16.75% employer costs, as well as notably low wages throughout the country. As a country, India has no set minimum wage. Instead, respective state governments set the minimum wage in each region, defining thousands of jobs for unskilled workers in over 400 employment categories. On average, this works out at around INR 176 (GBP 1.75) per day, equating to only INR 4,576 (GBP 45.45) per month.

However, although low salaries are a pro for many businesses, it’s worth noting that just over 21% of workers in India are ‘skilled’, ranking India 129th amongst the 162 countries surveyed in the Human Development Report 2020.

Africa

If you’re looking to employ in Africa, you’ll benefit from some of the world’s lowest national minimum wages and employer costs.

In South Africa, employer costs add up to 2% of an employee’s gross salary, the minimum of which is just ZAR 3262.47 (GBP 153.72) a month. Employers are required to register all employees with the Unemployment Insurance Fund and the Workers’ Compensation Fund once a month. The contribution is solely the employer’s responsibility and money mustn’t be deducted from a worker’s salary.

The costs of employing someone in Angola sit at 8% of an employee’s salary, but the monthly minimum wage varies across industries: AOA 21,454 (GBP 28.74) for agriculture, AOA 26,817 (GBP 35.92) for transport, services and manufacturing and AOA 32,181 (GBP 43.10) for trade and the extractive industry.

Somewhere in the middle is Nigeria, where it’ll cost you around 12% of an employee’s salary — the minimum is NGN 30,000 (GBP 53.66) a month — to employ them.

However, whilst both salaries and employer costs are low in Africa, employing across African nations is not without challenges. Many countries in Africa have unstable economies and political instability as well as poor infrastructure, which could create obstacles for your business expansion goals.

South America

It may come as a surprise to learn that South America has the highest employment costs globally, with Brazil’s sitting at 40 times higher than Denmark.

Employers in Brazil face paying up to 30% employer costs in social security contributions and the Employees Severance Indemnity Fund. And employing in Mexico will cost you 43.72% of your employee’s salary thanks to the mandatory contributions to social security, retirement funds and the National Housing Fund.

Additionally, a report from the International Labour Organisation (ILO) indicates that in Argentina, the total cost for employers to hire an employee averages around 1.45 times the employee's salary. This figure accounts for the salary itself plus mandatory employer contributions and taxes- which is made up of a range of 26.5% to 30% of the employment cost for each employee.

However, national minimum wages across all of South America are low — just BRL 1,100 (GBP 142.63) in Brazil and MXN 4,310 (GBP 156.01) in Mexico per month — meaning the high employer costs are balanced out.

North America

In Canada, employers are responsible for deducting pension contributions, employment insurance premiums, health tax and workplace safety insurance. Employer costs everywhere other than Quebec (where it’s 13.57% of a worker’s salary) sit at 7.66%. Monthly minimum wages vary between provinces in Canada but are generally fairly high. It’s set at CAD 1,776 (GBP 1,028.85) in Alberta, CAD 1,705 (GBP 987.72) in British Colombia, CAD 1657.37 (GBP 960.13) in Ontario and CAD 1551.20 (GBP 898.63) in Quebec.

But employing in Canada certainly has its perks, too. Doing business in the country is easy, corporate tax rates are just 15% and its workforce is the most educated in the world.

Employer costs in the US also vary from state to state, but the national federal costs are 13.65%. Employers can expect to pay up to 27% of their employees’ salaries in states such as New York, whilst other states such as Iowa stick to the federal guidelines. The federal minimum wage in the US is USD 1,256.70 (GBP 927.63) per month — but, again, this varies by state.

However, the potentially high cost of employing someone in the US might be worth it in the end; after all, the US has the world’s largest economy and is home to some of our generation’s most brilliant innovators.

Oceania

Despite their distance from the rest of the world, Australia and New Zealand are some of the most exciting territories for global expansion, with progressive employee benefits plans and a notably business-friendly environment.

Total employer costs in Australia come to 15.85% and are made up of 4.85% payroll tax, 1% towards Medicare and 10% towards each employee’s superannuation (pension) fund. The national minimum wage down under increased to AUD 203.33 (GBP 107.65) per week or AUD 2,518 (GBP 1,333.12) a month in 2021.

In New Zealand, employer costs are just 4%. Employers have to pay for their employees’ KiwiSaver (pension) and the Accident Compensation. Whilst this is comparatively low to many other nations, the national minimum wage is NZD 2,425 (GBP 1,208.45) per month.

Our global business expertise, your global business success

Knowing the salary expectations in a given country is a great place to start when looking to hire overseas. But on top of each employee’s base international salary, employers must also consider the additional employer costs — from taxes to statutory benefits and bonuses — as well as the pros and cons of hiring in and expanding into that country.

Even if a country doesn’t require the employer to pay mandatory contributions or benefits, you may need to think about doing so anyway to ensure you stay competitive and gain access to a country’s top talent. If you’re operating across multiple countries, you’ll also want to ensure your employees are treated equally by offering the same or equivalent benefits across the board.

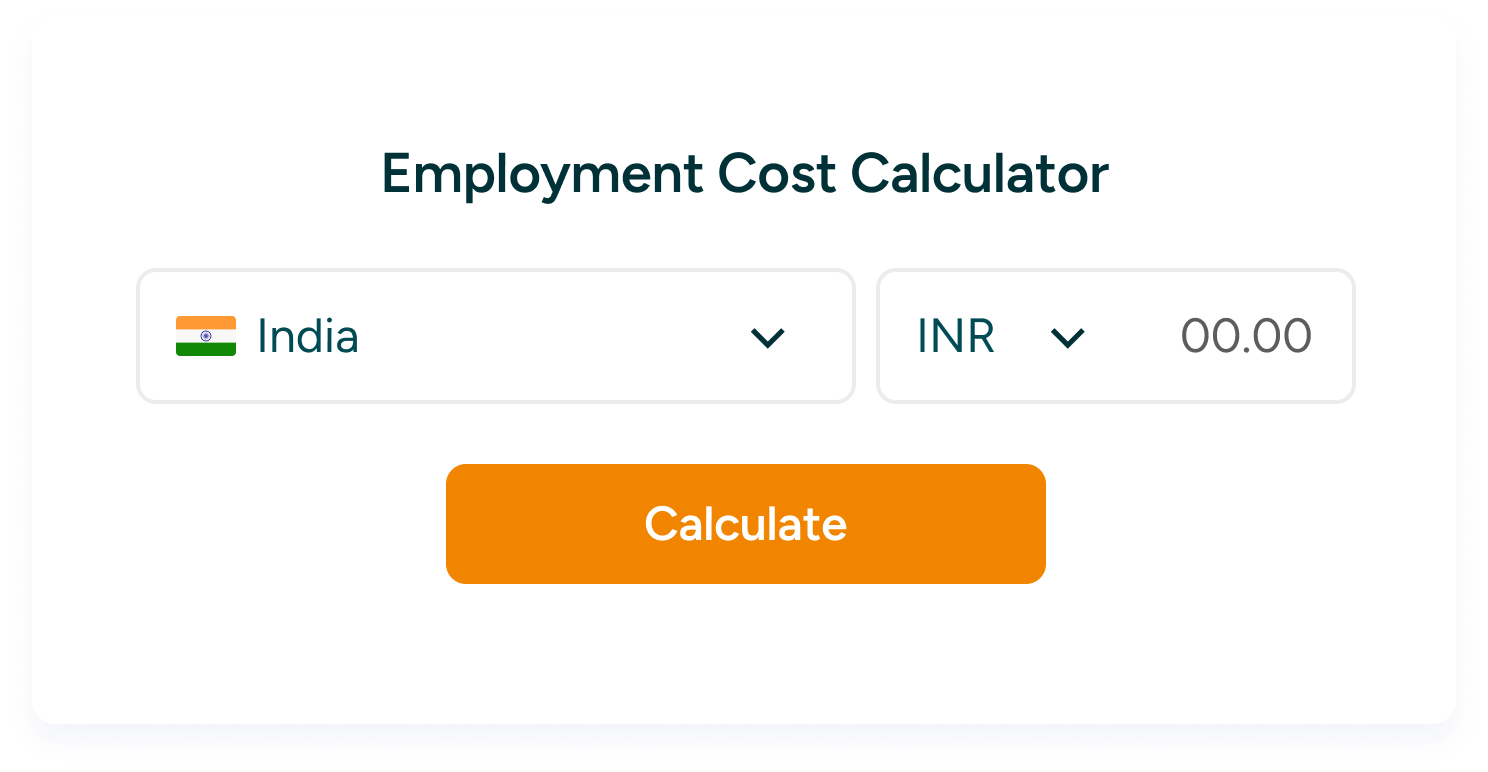

A global employer of record (EOR) and multi-country payroll provider like TopSource Worldwide could be the solution you need to ensure consistency across your global business operations. By using our global payroll solutions and employment services and taking advantage of our international reach, you can benefit from country-specific expertise that helps you determine the costs of employing someone anywhere in the world.

We operate in every major market across the globe. Our wealth of knowledge and expertise means you can trust our global payroll service offering and global EOR solutions in dozens of locations. Contact us at sales@topsourceworldwide.com or give us a call on +44 (0)203 691 5284 to find out how we can help.