The COVID-19 pandemic, peaking in previous years, brought global supply chains into sharp focus, underscoring how crucial they are for businesses. Despite initial challenges, organisations have adapted, embracing digital transformation and remote working to overcome barriers to global expansion.

The pandemic’s physical and mental constraints, particularly prominent in 2020 and 2021, have now largely given way to a digitally interconnected world. With increased reliance on online communication, businesses are more connected globally than ever before.

As 2024 unfolds, and the dynamics of a globalised world continue to evolve, companies are now reorienting towards international growth, considering lessons learned from the pandemic as they plan and prepare for global expansion.

Key considerations for global expansion in a post-pandemic world

So, now that globalisation’s back, what will organisations need to keep in mind when laying out their plans for global expansion in a post-pandemic world?

Driving business forward with remote working

The shift to remote working, initially a necessity during lockdowns, has become a strategic asset. The blend of remote and hybrid models, widely adopted in 2021, remains integral in 2024.

And thanks to global digitisation and the rapid development of communications technology, many organisations who adopted remote working due to the pandemic, are now reaping the benefits long term.

In 2024, globalisation is no longer just about the international trade of goods. Instead, it also centres on companies’ ability to hire talent without boundaries. Therefore, making remote working a permanent feature of business models and expansion plans will allow your organisation to hire employees from anywhere in the world.

While remote working has made hiring global talent a whole lot easier, hiring overseas workers isn’t always a walk in the park. There are plenty of administrative and regulatory hoops for businesses to jump through to ensure the hiring and onboarding process is handled correctly and that compliance is met at every turn.

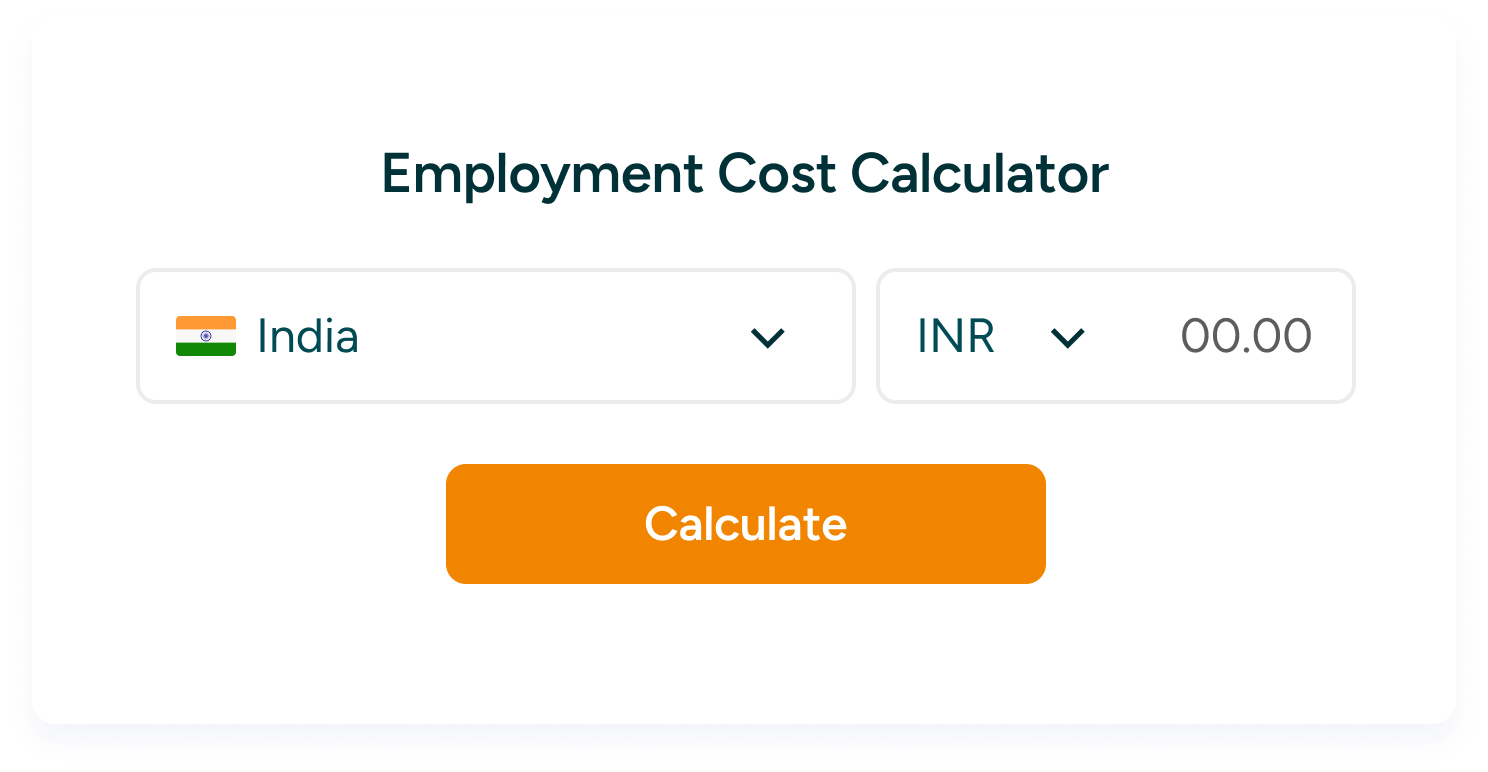

As such, a global employer of record (EOR) will likely form the backbone of many companies’ global expansion plans in 2024 — enabling them to choose the right people for their business without worrying about all the heavy lifting and administrative burdens that happen behind the scenes.

Putting customer experience first

Enhancing customer satisfaction will also be a top priority for many businesses considering global expansion in 2024. If companies want to operate on a global scale and have workers stationed all over the world, customers still need to feel that they’re working with or buying from a single, unified business.

Employee productivity impacts customer satisfaction significantly. So, no matter where employees are based, they’ll need to be managed efficiently to provide a seamless experience that keeps customers happy. Outsourcing to a global EOR enables companies to streamline their HR processes and remove the headaches of managing a global workforce across various time zones and jurisdictions — which is essential for maintaining productivity as companies scale up and across international borders.

Embracing digital savviness

In 2024, digitally savvy businesses lead the way. Emphasising paperless operations and leveraging digital tools for workforce management is crucial for successful global expansion. Not only does going paperless have a positive impact on the environment, but it also allows organisations to access all aspects of their business from anywhere in the world, at any time.

Taking advantage of the digital tools available makes managing a global workforce much more straightforward, giving organisations the power to go further — in terms of growth and geography. For global expansion in 2024, choosing an EOR provider with a centralised digital platform will be essential for enabling seamless international workforce management for your business.

Summary

In summary, the transformation of global business practices in response to the COVID-19 pandemic will serve businesses looking to expand globally in 2024 well. These include the integration of remote working into strategic plans, the shift in globalisation towards talent acquisition without geographical limits, and the importance of using global Employer of Record (EOR) services for compliance in international hiring. Prioritising customer experience in a globally dispersed workforce and the advantages of being digitally savvy for seamless global expansion are also key. By leveraging these insights, businesses can define a clear roadmap for adapting to the evolving landscape of global trade and workforce management in 2024, helping them to achieve global expansion more effectively.

As a global employer of record, TopSource Worldwide will act as an extension of your business, managing all your international employment requirements to drive your overseas expansion and help you unlock business around the world. So, don’t let fear prevent your global expansion in 2024. Our team and experts on the ground can help you smooth out the complexities associated with expanding overseas and guarantee compliance across every aspect — all while keeping costs down. Get in touch today.